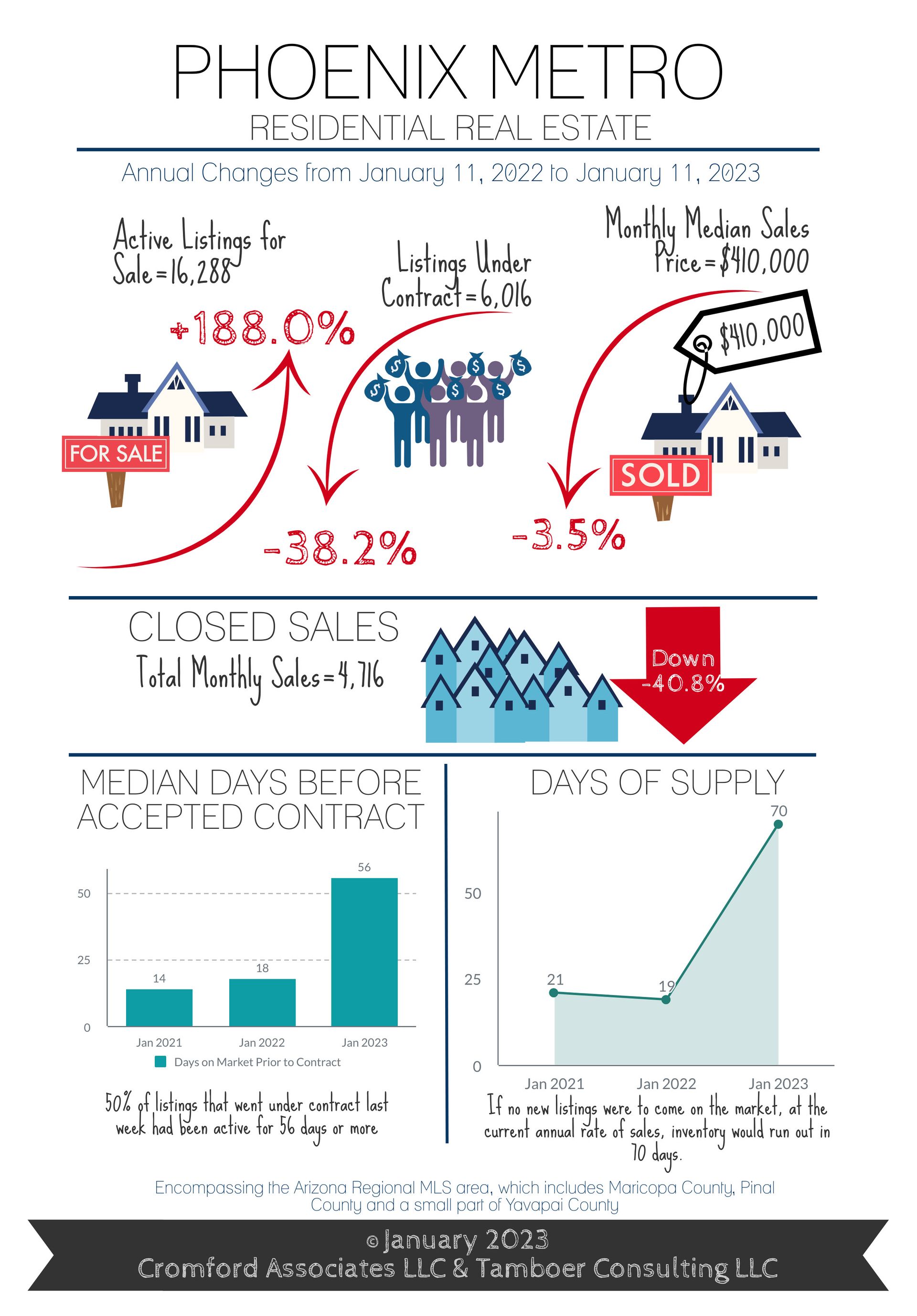

January 2023 Phoenix Real Estate Snapshot

Phoenix Buyer Market - Aaaand It’s Gone; Median Price Down $65,000 Since May

For Buyers:

Last year, traditional buyers took a back seat to an influx of cash investors and speculators who outbid them. Then mortgage rates increased and suppressed their power even more. This was especially prominent in the market under $500K where owner occupant buyers made up just 56.8% of sales in June (normally 70-75%), and investors took 31% (normally 11-17%).

As of November, traditional buyers have once again returned to 71% market share under $500K, and investors have retreated under 20%. Investors make up the majority of losses associated with recent price declines. This is great news, especially for first-time home buyers, as prices have come down significantly for starter homes. The median sales price for a 1,400-1,600 sq. ft. single family home has declined from $435K in May to $370K so far in January; a decline of $65,000, or 15%. At today’s mortgage rate of 6%, that’s a savings of at least $352 per month in payment.

This is in line to the overall median sales price, which also declined $65,000 from $475K to $410K. To sweeten the pot, both FHA and conventional loan limits increased for 2023. FHA increased from $441,600 to $530,150, and many lenders began honoring the 2023 loan limit before 2022 ended. As a result, the market share of sales with FHA financing under $500K increased from a low of 11% in March to 20% by November.

Many first-time home buyers take advantage of FHA financing as they have softer requirements for approval and their rates are typically lower than conventional loans. Some buyers believe that prices will continue to drop dramatically in 2023 and continue to wait. However, after a brief 4-week Buyer Market from November to December, the ratios of supply to demand are showing Greater Phoenix moving back into a Balanced Market. This means less downward pressure on price going forward and, if inflation and mortgage rates continue to decline, the worst may be behind us.

For Sellers:

Happening right now is a shift out of the shortest Buyer Market ever recorded by the Cromford Report. The shift is a direct result of the fewest number of listings added to supply in the 4th quarter of the year going back to 2000. Fewer listings mean fewer competitors for sellers. Demand is still very low, but when it’s met with low supply there is less downward pressure on price.

In November, every region in Greater Phoenix was in a Buyer Market except for the Northeast Valley. By mid-January, Phoenix, Glendale, Mesa, Tempe, Avondale, Gilbert, and Chandler had all come out of Buyer Markets and into Balance, except for Chandler which leapt into a Seller Market. Not far behind are Peoria and Surprise. The only large cities left in strong Buyer Markets are Goodyear, Queen Creek (including San Tan Valley), Maricopa, and Buckeye.

This does not mean that sellers can expect 2021 and 2022 scenarios to come back. Price drops, negotiations, concessions, and rate buy-downs will continue to be the key to keeping buyers in the game this quarter.

Currently, 51% of all January sales have involved some form of concession from the seller, with a median cost of $9,854; in line with the cost of a temporary rate buy-down. While Avondale is in a Balanced market, 85392 over the last 30 days showed 14 out of 15 sales with concessions and a median of $12,000 to buyers. In addition to concessions, final sale prices are showing sellers getting an average of 96.7% of their last list price.

This is not unusual for a Balanced Market. The luxury market over $1.5M sees fewer concessions, but more price negotiation. January sales so far show sellers closing at an average of 94.5% of their last list price in this segment.

Under $500K, sellers are closing at 97.4% of list price. All in all, the majority of sellers are coming out ahead at closing. 65% of active resale listings have been owned for at least 2 years. The long-term appreciation rates for homes in Greater Phoenix are as follows using January sales to date: 25% for 2yrs., 50% for 3yrs., 63% for 4yrs., 70% for 5yrs., and 86%+ for 6yrs or more.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2023 Cromford Associates LLC and Tamboer Consulting LLC

Living In Scottsdale

We are committed to providing an accessible website. If you have difficulty accessing content, have difficulty viewing a file on the website, notice any accessibility problems, or should you require assistance in navigating our website, please contact us.

©Copyright - All Rights Reserved

Website Powered by National Association of REALTORS®