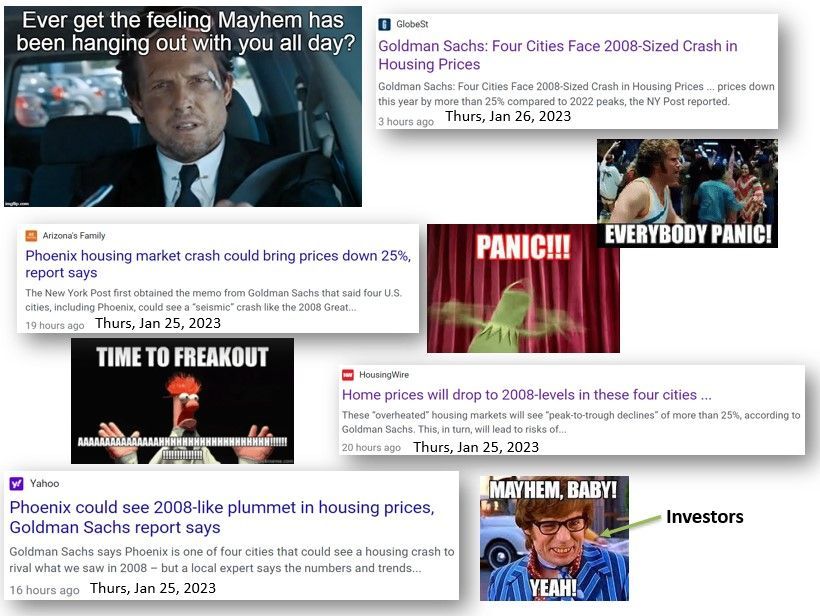

Goldman Sachs "Phoenix Market Crash" Prediction Has Little Basis in Reality

Comments by Michael Orr, Founder of The Cromford Report

"There is a story run by Fox Business News and other news outlets today that quotes Goldman Sachs making all kinds of weird and unlikely forecasts. Not quite sure how to deal with it because its description of the current Phoenix market bears little comparison with the real world.

Some quotes are:

- Goldman Sachs expects home values to worsen through 2023 amid continued skyrocketing interest rates and declining housing prices

- Four US cities will suffer the most catastrophic dips, drawing comparisons to the 2008 housing crash

- Phoenix Arizona will likely see noticeable increase before drastic decreases of more than 25%

My comments are:

- We saw skyrocketing interest rates in 2Q and 4Q of last year. The idea that interest rates will skyrocket in 2023 seems more than a little far-fetched when the inflation rate is falling. It could happen, but to have this as your base case seems very irresponsible.

- Is Goldman Sachs really saying Phoenix home prices will go up and then drastically down? Come on now, there is no data that supports that outlook. Just a wild-ass guess?

- In the Great Recession, the median price in Phoenix declined from a peak of $265,000 in June 2006 to a low of $109,000 in May 2011. That is a fall of almost 60%.

- Please let us not compare 60% with 25%. They are not similar.

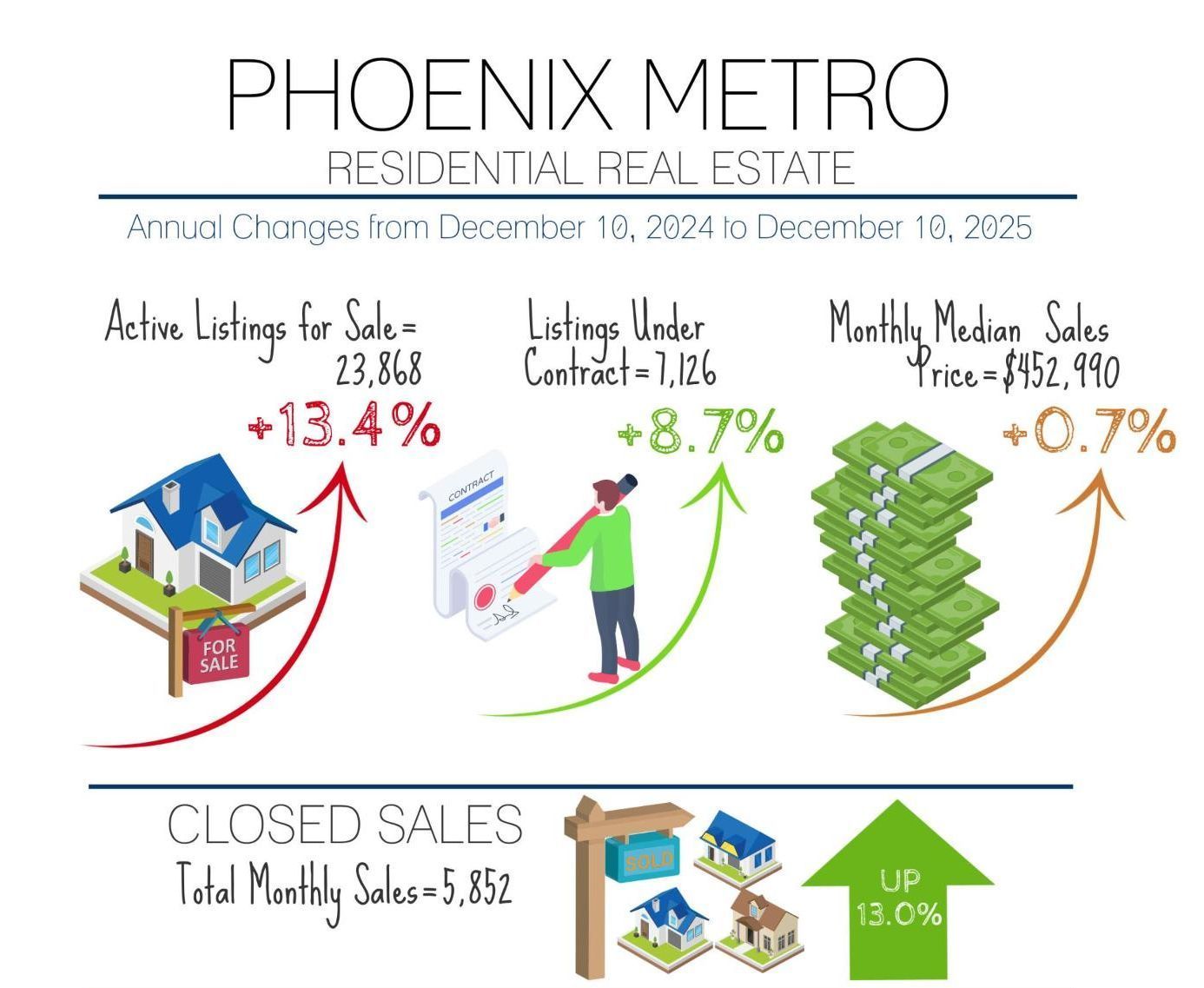

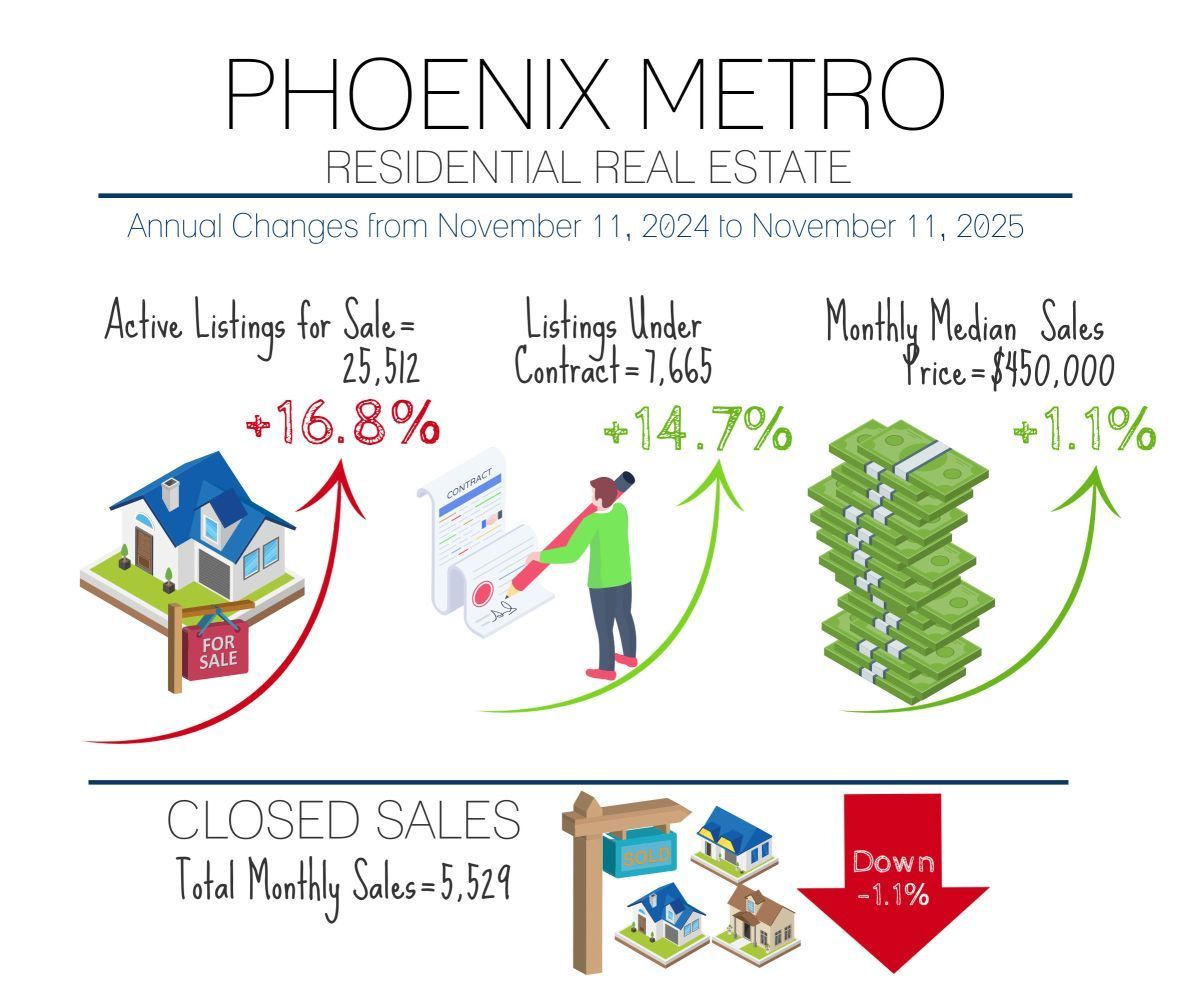

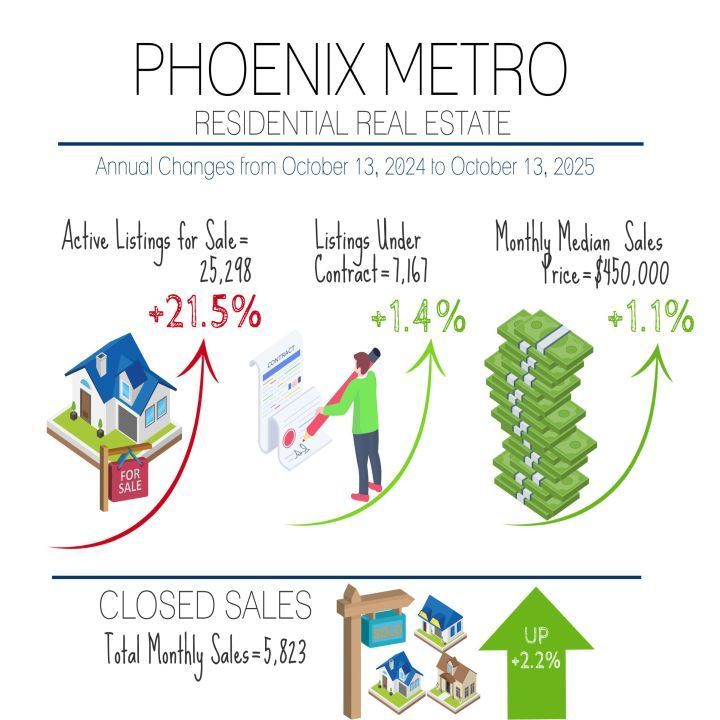

- Since the peak in May 2022 of $475,000, the median was down to $412,000 by December. This is a fall of 13% so far.

The lack of coherent thinking in the text of the article contrasts with the interview with Ara Hovnanian that appears on the same web page. I went away with the impression that Ara Hovnanian has his head screwed on tight and that the Goldman Sachs housing analyst has lost the plot. Maybe Sky Business garbled the message that Goldman Sachs put out?

Also confusing are Goldman Sachs recent forecasts of interest rates:

- November - mortgage rates will drop to 5% by March and property values will rise 1.8%

- December - 6.2% average rate for 2023

- January - 6.5% by 2023 year end (not sure how skyrocketing takes place in this context)

Noone has ever been very good at forecasting mortgage interest rates more than a couple of weeks in advance. This includes the Mortgage Bankers Association and it especially includes Goldman Sachs whose track-record on interest rate forecasts is extremely poor. This is not saying much because there is no-one who gets them right more than by random chance.

Any time spent listening to people making interest rate forecasts is time you could have spent more productively."

- Michael Orr, Founder of The Cromford Report, the recognized top authority on the economics behind the Greater Phoenix real estate market