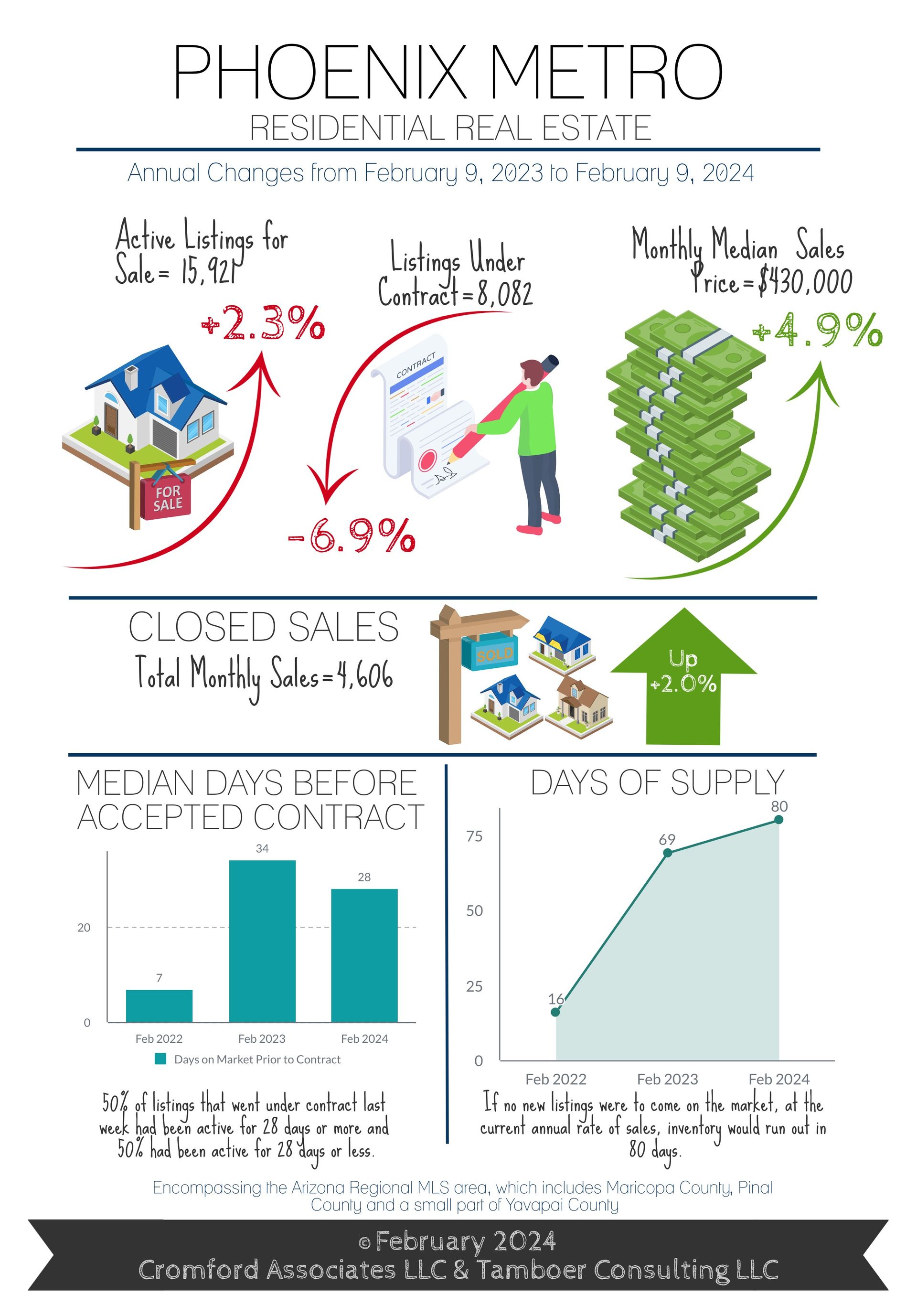

February 2024 Phoenix Real Estate Snapshot

How Presidential Elections Affect Housing,

Starter Homes are a Hot Market in Greater Phoenix

For Buyers:

With many existing home owners comfortably staying put these days, more attention is placed on first-time home buyers, affordability, and supply of homes. The first thing that comes to mind is the choice between renting and buying. According to RealData the median cost of a 3 bedroom apartment at a 50+ unit complex in Q2 2023 was $2,100 per month in Maricopa County. The median size is roughly 1,250 square feet. The past 30 days of sales show the median sale price of a 1,200-1,500 square foot, 3+ bedroom single family starter home to be $370,000 in Greater Phoenix.

Many first time home buyers put down 3.5% on a FHA loan ($13,000 on $370K), and last month nearly 70% in this price range had a seller or builder agree to contribute to closing costs with a rate buy-down. That’s a median contribution of $10,000 from the sellers. On February 1st, the average FHA rate was 6.0% according to Mortgage News Daily. With a 2/1 buy-down from the seller, the first year estimated payment would be $2,159 per month, including taxes, insurance, and PMI. A permanent 1% buy-down would equate to $2,375 per month. This puts the monthly cost to buy a small starter home within a few hundred dollars of the median rental rate.

In Pinal County, the median cost drops to $310,000 and over half of the properties sold in the past 30 days are newly built within the past 5 years or under contract for 2024. On a 2/1 FHA buy-down, the estimated PITI payment is $1,825 per month and a permanent 1% buy-down would be $2,006.

Currently there are 366 active single family listings between 1,200-1,500 square feet, with 3+ bedrooms, under $370,000 in the Arizona Regional MLS (Pinal County has 53% of them). There are 312 listings under contract and 191 closed in the last 31 days. This is a hot market segment.

2024 is expected to be another year of change for the Greater Phoenix housing industry, but this time the shift is expected to be towards stability in home appreciation and improved affordability measures as incomes catch up. After hitting rock bottom for demand in 2023, things are looking up.

For Sellers:

It’s an election year! Every four years there is an expectation that the drama, uncertainty, and manipulation that comes with presidential campaigns will dramatically affect the housing market, specifically prices or mortgage rates. Spoiler Alert: It doesn’t. The main influence on the housing market comes from policies, not the elections themselves. For instance, the stimulus packages and policies that were passed during the 2020 COVID-19 election year and continued into the next administration were the first stones to cause a ripple effect of fortunate and unfortunate events in the housing market over the past 4 years.

So what’s to be expected this year? There is one market that can be affected by an election, and that’s the stock market. After the last 4 elections, the stock market has responded positively afterwards, which affects both luxury buyers and retirees with a high percentage of cash purchases. If a cash buyer expects their investment portfolio to be worth more after an election, they may simply put off their home purchase until the Spring. This can cause contract activity to stagnate for a couple months, but not enough to affect prices, and this mild affect can be offset by other mitigating factors, like seasonality, that would make the impact unnoticeable.

So far in 2024, listings under contract over $1M are higher than 2022, which is the #1 record year for this price range. Active listings over $1M are also at record highs, which is offsetting the increased demand and keeping price appreciation stable. Retirement communities are not experiencing the same however, as this segment is highly sensitive to inflation. When prices for necessities are high and uncertain, many buyers in this segment will choose to keep their cash for safekeeping. Perhaps they’ll feel better after the election.