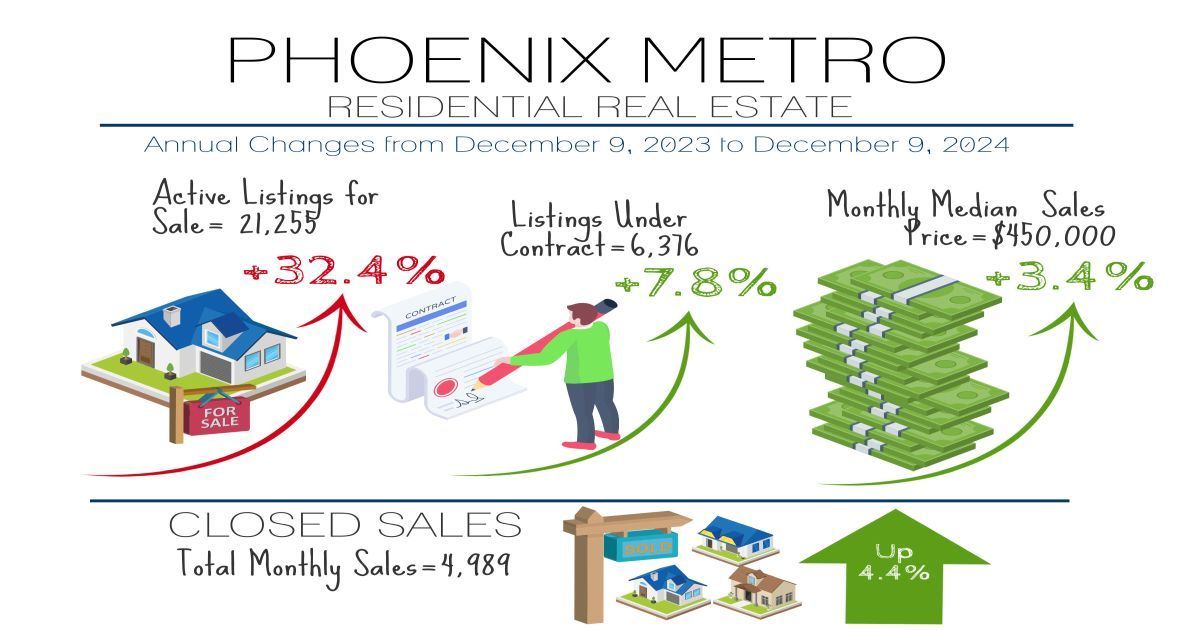

December 2023 Phoenix Real Estate Snapshot

Greater Phoenix Balanced Market May Not Last Long,

These Two Factors Could Further Drop Mortgage Rates in 2024

For Buyers:

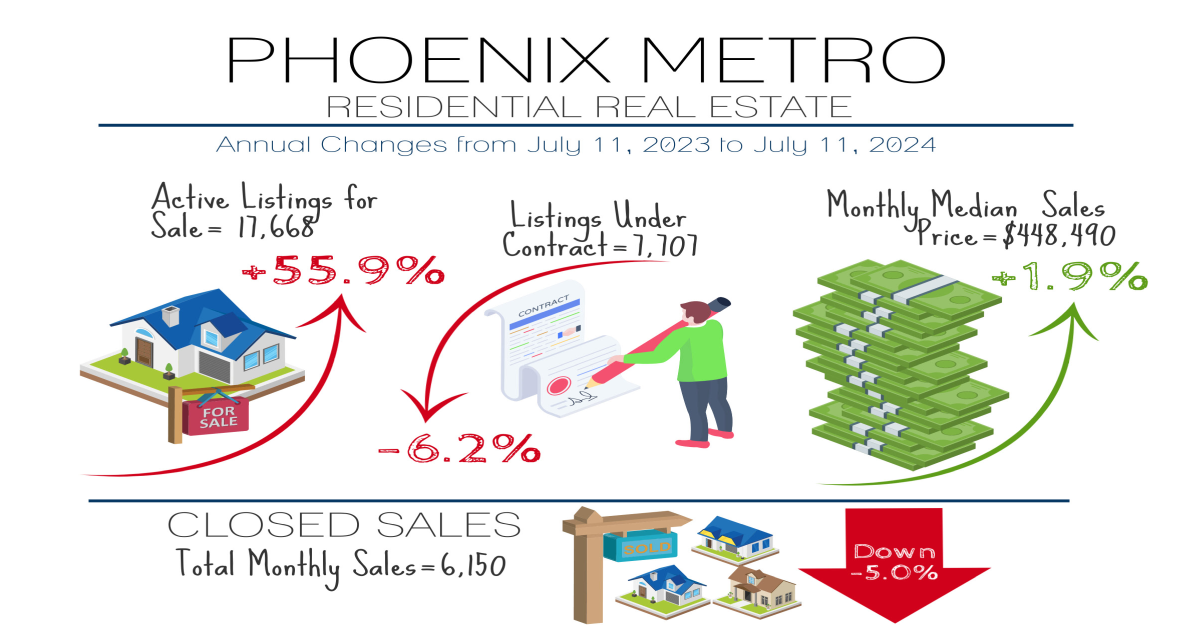

Greater Phoenix has moved out of a seller’s market and into a balanced market, but it’s unclear how long this opportunity will last for buyers. December is typically the calm before the storm each year for the housing market, and this year is no different. New listings are at their lowest this month as many sellers opt to wait until January to list their home. As a result, supply can become stale and picked over. However, the lull is a window of opportunity for negotiations as the remaining sellers want to be under contract before the wave of new listings come in the new year.

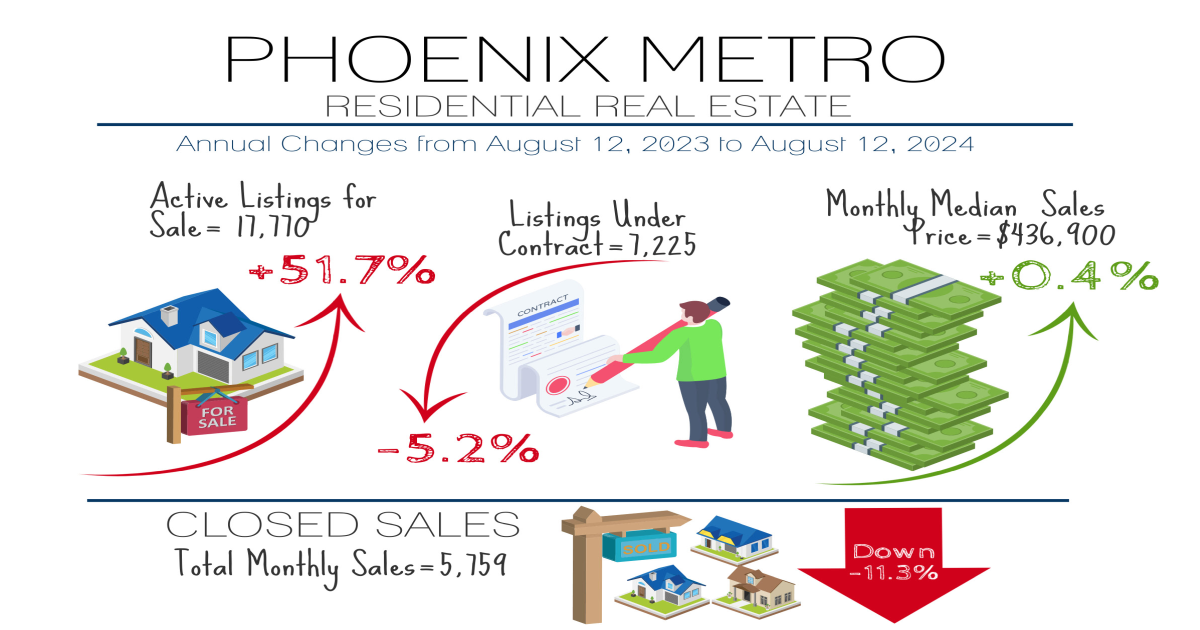

There is uncertainty mixed with hope in the market today as mortgage rates have declined from 8.0% to 7.0% since October. Every day the mortgage rate declines, more buyers are able to purchase. Last year, also from October to December, rates dropped from 7.4% to 6.1%. This was enough to pull the housing market out of a buyer’s market, into balance, and eventually into a seller’s market once again by January. This put upward pressure on price until May, when rates rose once again to 7%. If rates continue their decline and drop below 6.5%, we expect to see noticeable improvements in buyer demand as we enter 2024.

This November, the Consumer Price Index inflation rate took a turn down and the Federal Reserve did not raise the federal funds rate, and both measures were key factors in the current mortgage rate decline. This month, the inflation rate once again declined and the market expects the federal funds rate to remain unchanged, stirring emotions of hope and anticipation that rates will continue declining as mortgage applications rise.

The rapid decline of rates is preventing Greater Phoenix from dropping entirely into a buyer’s market at this stage, which is causing analysts to question how long the opportunity will last. The combination of a sustained balanced market and the weakest month of the year seasonally means that the best thing buyers can do is stay vigilant in their search for a home and take advantage of this quiet time. Once the new year begins, the market could heat up quickly.

For Sellers:

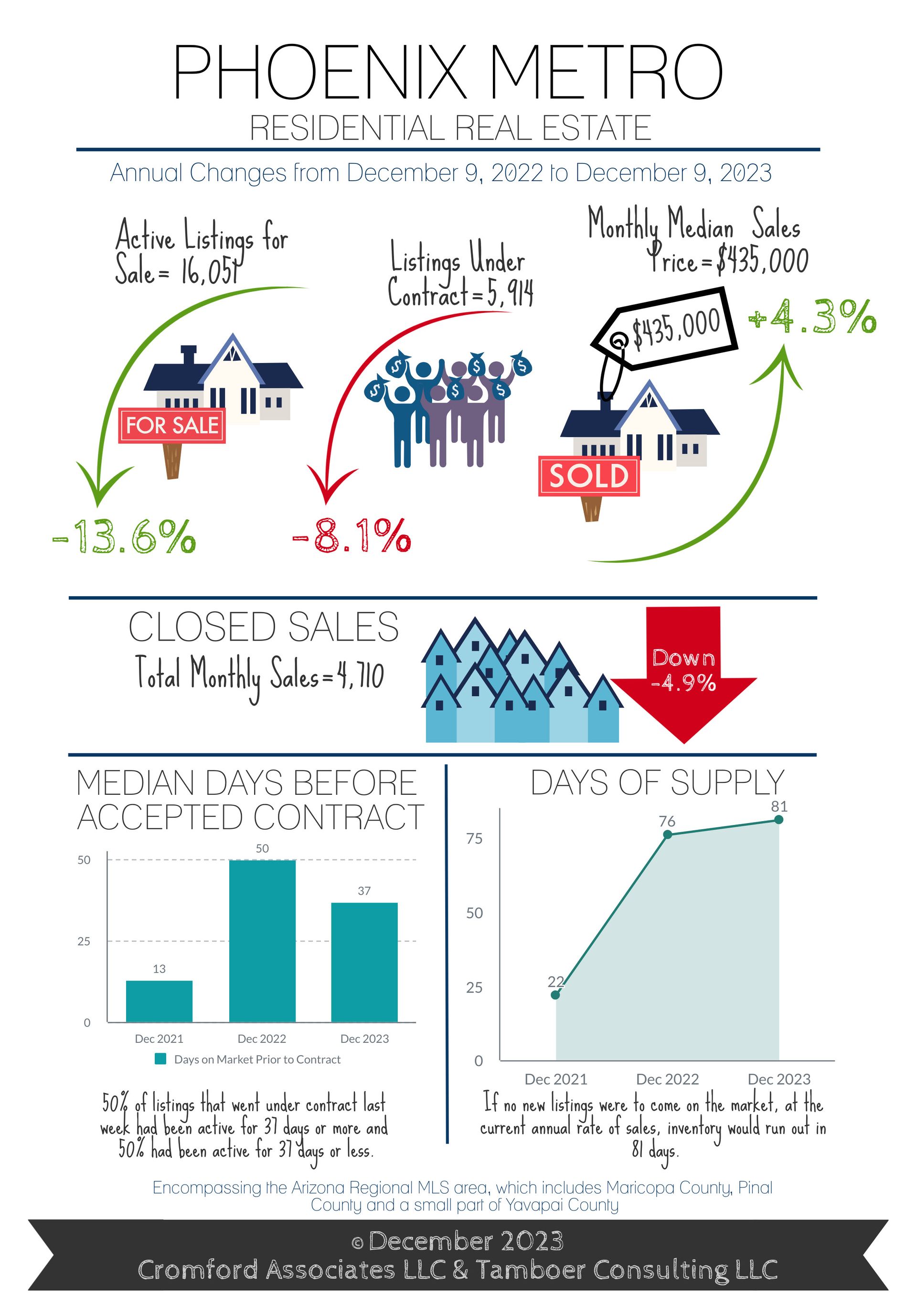

While Greater Phoenix is in a balanced market overall, it’s not evenly distributed. As of December 7th, most of the cities in Pinal County and the edges of the valley are in buyer’s markets. They include Cave Creek, Sun City, Surprise, Buckeye, Maricopa, Casa Grande, Queen Creek, and Gold Canyon. Balanced markets are Paradise Valley, Goodyear, Peoria, Sun City West, Litchfield Park, and Arizona City. All other cities are in seller’s markets, but much weaker than they were a month ago.

The top 5 seller’s markets, in order, are Tolleson, Anthem, Apache Junction, El Mirage, and Sun Lakes. Close behind are Chandler, Laveen, and Fountain Hills. While these cities lean the most towards sellers, the only cities showing significant price increases since June are Anthem, Sun Lakes, and Fountain Hills. Despite being strong seller’s markets, Laveen and Tolleson have 76% and 71% of their sales closing with significant buyer incentives at median costs of $13,500 and $10,000, much higher than the valley-wide measures of 44% and $9,626 for December.

Leading supply and demand measures indicate sales price measures should go flat over the next 3-6 months. Demand is expected to increase once the new year begins, but competing supply may offset it. Pushing the market too far on the price it’s willing to bear will most likely result in more days on market. Focusing on getting your home in the best possible condition, budgeting appropriately for buyer incentives, and managing expectations for price will get your home sold faster in this environment. These are the markets where quality marketing, exposure, and agent representation truly make a difference.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2023 Cromford Associates LLC and Tamboer Consulting LLC